By Jeff Skolnick, CPA

The recently passed tax law contains many changes to existing law. The final bill was almost 1,000 pages. I have summarized what I believe to be the key tax provisions of the law.

- EXTENSION OF AND CHANGES TO CURRENT INDIVIDUAL PROVISIONS

Many of the provisions enacted by the Tax Cuts and Jobs Act (TCJA) that were set to sunset at the end of 2025 have now been made permanent.

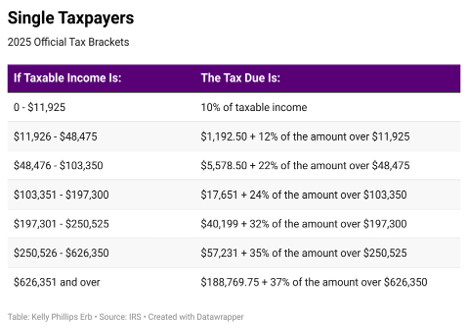

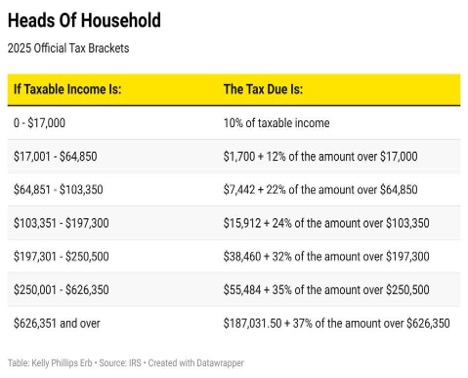

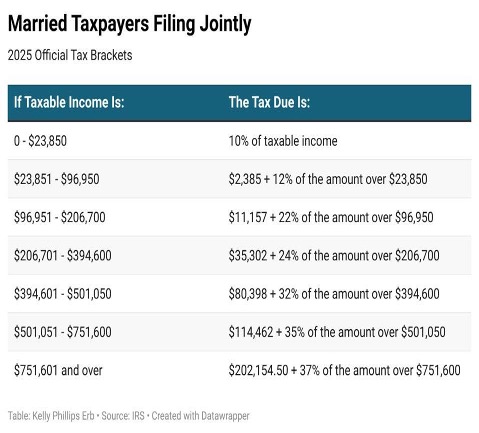

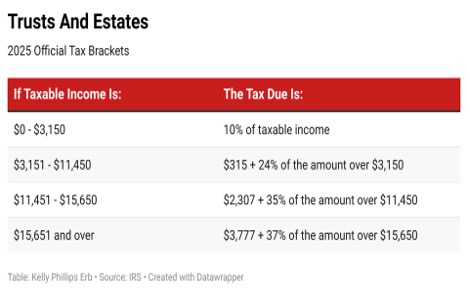

Tax rates – There are seven different income tax rates. Before 2018, the seven were 10, 15, 25, 28, 33, 35 & 39.6. These were replaced by 10, 12, 22, 24, 32, 35 & 37. These new rates were scheduled to sunset after 2025 but are now permanent. The new rate charts for 2025 are shown below:

Increase in Standard Deduction. The standard deduction for married individuals filing jointly is raised in 2025 to $30,000. It is also raised to $22,500 for those filing as head of household and $15,000 for everyone else. These figures are adjusted annually for inflation, and additional amounts are added for those 65 and older or blind ($1,600 for each married taxpayer and $2,000 for each unmarried taxpayer in 2025). The increased standard deduction amounts, adjusted for inflation, were intended to sunset after 2025 but are now permanent.

Personal exemptions were eliminated after 2017. The new law temporarily allows a $6,000 exemption for those 65 and older for years 2025-2028. This exemption is reduced by 6 percent of the taxpayer’s modified adjusted gross income (MAGI) that exceeds $75,000 ($150,000 in the case of a joint return). In other words, if a single individual 65 years of age or older had a MAGI of $100,000, the additional $6,000 exemption amount would be reduced by $25,000 (the amount MAGI exceeds $75,000) multiplied by 6%, or $1,500. The resulting exemption would be $4,500 ($6,000 less $1,500).

Increase in Child Tax Credit. The child tax credit, which had doubled from $1,000 to $2,000 for children under the age of 17 in 2018, has now been increased to $2,200. The maximum amount of refundable credit allowed is $1,700 per child. Both the $2,200 and $1,700 will be adjusted annually for inflation. Additionally, a $500 credit is available for all dependents, except those who qualify for the larger credit (for example, older children or parents). Income phase-out limitations remain at $400,000 for joint filers and $200,000 for all other filers. This law, which became effective in 2018, was scheduled to sunset after 2025 but has now become permanent.

Deduction for Qualified Business Income of Pass-Thru Entities (Section 199A) – Beginning in 2018, the law allowed a 20% deduction for sole proprietors, partnerships, and S corporations. There are several limitations that must be met, and the calculation is limited to 20% of taxable income, excluding capital gain income. Additional limitations are imposed for personal service businesses. Personal service businesses are defined as any trade or business involving the performance of services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of 1 more of its employees or owners. Once the taxable income threshold is met ($197,300 for individuals in 2025 and $394,600 for married individuals filing jointly(these numbers are adjusted for inflation)), these provisions begin to be phased out over the next $75,000 for individuals and $150,000 for married individuals filing jointly (up from $50,000 and $100,000 enacted in 2018). For taxpayers in businesses other than personal service businesses once the taxable income has reached additional limitations based on W-2 wages paid and the original cost basis of certain equipment applies to taxable income.

The new law creates a new minimum deduction of $400 (adjusted for inflation) for eligible taxpayers with qualified business income of at least $1,000.

The law also makes Section 199A permanent. It was set to expire after 2025.

Estate and Gift Tax Exemption is $15,000,000 per person in 2025. This number is indexed for inflation.

Alternative Minimum Tax – has been changed for individuals. The exemption amounts of $137,000 (married) and $88,100 (single), first created by TCJA in 2018, have now been made permanent (indexed for inflation). The phaseout amounts are $1,252,700 and $626,350, respectively in 2025 (indexed for inflation). The new law does change the phaseout rate from 25% to 50%, meaning that you lose $1 of exemption for every $2 your income exceeds the phaseout threshold. The previous law had been 25%, meaning you lose $1 of exemption for every $4 your income exceeds the phaseout threshold.

Qualified Residence Interest after 2017 were limited to acquisition indebtedness of $750,000 ($375,000 in the case of a married individual filing a separate return). This provision has been made permanent.

Home equity interest remains non-deductible. This provision is now permanent.

Personal Casualty Losses are limited to federally and state-declared disaster areas. Before the new law, only federally declared disaster areas were eligible for assistance.

Miscellaneous Itemized Deductions, which were previously suspended as deductions, are permanently not deductible. These expenses include tax preparation fees, investment fees, and unreimbursed employee expenses.

Overall Limitation on Itemized Deductions. The law permanently removes the overall limitation on itemized deductions and replaces it with a new overall limitation on the tax benefit of itemized deductions. The amount of itemized deductions otherwise allowable would be reduced by 2/37 (roughly 5.4%) of the lesser of (1) the amount of the itemized deductions or (2) the amount of the taxpayer’s taxable income that exceeds the start of the 37% tax rate bracket.

Commuting Reimbursements. The new law excludes bicycle commuting reimbursement from the list of nontaxable transportation fringe benefits. Transportation fringe benefits allowable are:

- Transportation in a commuter highway vehicle, if such transportation is in connection with travel between the employee’s residence and place of employment.

- Any transit pass

- Qualified parking

In 2025, the limit for transportation in a commuter highway vehicle and/or any transit pass is $325 per month. The 2025 limit on qualified parking is also $325 per month. Therefore, the maximum excludable for an employee who is reimbursed for a vehicle or transit pass and has qualified parking is $650 per month.

The Moving Expense Deduction, which had been repealed after 2017 but was set to be reinstated after 2025, is now permanently repealed. Additionally, reimbursements paid to an employee for moving expenses are now considered taxable income. There are exceptions to both rules for military personnel.

Gambling Losses. After 2025 are limited to 90% of gains from wagering transactions during the tax year.

Able Accounts are accounts established for individuals who meet specific disability requirements. If the requirements are met, contributions can be made, which are not deductible; however, the income accumulates tax-free. There will be no tax upon withdrawals if they are paid for qualified expenses. The bill made permanently some increased contributions to ABLE accounts and possible eligibility for a Saver’s Credit up to $2,100.

Student loans discharged on account of death or disability will not be counted as income under the discharge of indebtedness rules after 2017. This rule has now been made permanent. Typically, when a loan is forgiven, the forgiven amount is considered taxable income unless it qualifies as an exception. Current exceptions include bankruptcy, insolvency, qualified farm indebtedness, and for non-C corporations, and qualified real property indebtedness.

Limitation on Deduction for State and Local Taxes. Beginning in 2025, the overall limitation on state, local, and property taxes will be capped at $40,000 for married individuals filing jointly and $20,0000 for those filing a separate return (up from $10,000 and $5,000, respectively). In 2026, the cap will be $40,400 / $20,200, and then it will increase by 1% annually through 2029. Starting in 2030, it will revert to $10,000.

- NEW PROVISIONS – INDIVIDUALS

No Tax on Tips. The new law allows a deduction for up to $25,000 of qualified tip income received by an individual in an occupation that customarily receives tips. This deduction is available to both employees and independent contractors. It is also available to both individuals who itemize their deductions and those who use the standard deduction. The deduction begins to phase out at $150,000 ($300,000 for joint filers). This law is in effect from 2025 through 2028, when it is scheduled to sunset.

No Tax on Overtime. The new law allows a deduction for up to $12,500 of qualified overtime income received by an individual. This deduction is available to both employees and independent contractors. It is also available to both individuals who itemize their deductions and those who use the standard deduction. The deduction begins to phase out at $150,000 ($300,000 for joint filers). This law is in effect from 2025 through 2028, when it is scheduled to sunset.

Car Loan Interest. The new law allows a deduction for up to $10,000 of qualified passenger loan interest paid by an individual. The loan must be for a purchase made after 2024 of a personal-use passenger vehicle. The final assembly of a qualified vehicle must occur within the United States. This deduction is available to both individuals who itemize their deductions and those who use the standard deduction. The deduction begins to phase out at $100,000 ($200,000 for joint filers). This law is in effect from 2025 through 2028, when it is scheduled to sunset.

Trump Accounts. These are treated under the law as individual retirement accounts (IRAs) for children. There is no deduction for contributions (which can be up to $5,000 per year, indexed for inflation after 2027), and they grow tax-deferred until such time as the funds are distributed. Contributions can only be made in years before the beneficiary is 18 years of age, and withdrawals can be made no earlier than the year the beneficiary turns 18. A qualified contribution is not allowed until 12 months after this law was enacted.

The law allows employers to contribute to Trump Accounts up to $2,500 per employee (indexed for inflation after 2027).

This is a federal government pilot program that has been established to provide a $1,000 tax credit for opening a Trump Account for babies born between 2025 and 2028.

- BUSINESS TAX PROVISIONS

Bonus Depreciation. The law makes 100% bonus depreciation permanent. Bonus depreciation applies to both new and used property with a recovery period of 20 years or less.

Research and Development. The new law allows immediate deduction of domestic research and experimental expenses paid or incurred after 2024. Foreign research and development expenses will continue to be amortized over a 15-year period.

Qualified small businesses (those with annual sales of $31 million or less) may elect to amend 2022 – 2024 to apply these rules. For all other entities, they will have the option to amortize the remaining domestic research and development expenses over one or two years, beginning in 2025.

Limitation on Business Interest. Companies that average $31,000,000 or more in sales (indexed for inflation) are limited in the amount of interest that may be deducted. This number is limited to 30% of the adjusted taxable income. Taxable income is adjusted by adding back certain deductions such as depreciation, amortization, depletion, net operating losses, and the Section 199A deduction for Qualified Business Income of Pass-Thru Entities.

The Family and Medical Leave Credit. Credit is available to businesses that allow at least 2 weeks of annual paid family and medical leave. This credit has been made permanent.

Increased Section 179 Expensing. Beginning after 2024, the annual first-year expense amount will be $2,500,000 (up from the current $1,000,000). The phaseout, which currently starts at $2,500,000, is raised to $4,000,000. This deduction is available for new and used equipment. Most assets, except real property, are eligible. Qualified real property is eligible. Qualified real property is specific improvements made by either a landlord or a tenant in a nonresidential property.

Qualified Production Property. Qualified production property is generally nonresidential real estate used in the manufacturing, production or refining of a qualified product. The law allows immediate 100% deduction of these expenses.

Advanced Manufacturing Investment Credit. For eligible property placed in service after 2025, the credit rate increases from 25% to 35%. This credit primarily applies to facilities that manufacture semiconductors or semiconductor manufacturing equipment.

- PERMANENT INVESTMENTS IN FAMILIES AND CHILDREN

Employer-Provided Child Care Credit. The law allows 40% of qualified child care expenditures for employees (up from 25%) and 50% for eligible small businesses (those with an average gross income of less than $31 million for the last three years), plus 10% of qualified child care resource and referral expenditures.

The overall credit limit dollar limit is now $500,000 (up from $150,000 and $600,000 for eligible small businesses). The $500,000 and $600,000 amounts are indexed for inflation.

Adoption Credit. The law now allows up to $5,000 of adoption credit to be refundable. This amount will be adjusted for inflation.

Dependent Care Assistance Program. The annual amount employees are allowed to reduce their salary for dependent care assistance has been raised from $5,000 to $7,500 ($3,750 for married filing separately).

Child and Dependent Care Assistance Program. The law increases the percentage of qualifying expenses from 35% to 50%. This percentage is reduced (but not below 35%) for each $2,000 that the taxpayer’s adjusted gross income exceeds $15,000.

The credit is further reduced (but not below 20%) for each $2,000 ($4,000 for joint filers) that the taxpayer’s adjusted gross income exceeds $75,000 ($150,000 for joint filers).

The new law begins with tax returns filed for years after 2025.

Tax Credit for Contributions of Individuals to Scholarship Granting Organizations. The new law allows a credit of up to $1,700 for individuals who donate to state-approved scholarship-granting organizations. Scholarships must be awarded to eligible students within the state where the organization operates.

A new Internal Revenue Code Section 139K has been created, which excludes the scholarship from the recipient’s income.

Exclusion for Employer Payments of Student Loans. The new law makes permanent the exclusion from income of amounts paid by an employer to either the employee or to a lender, principal, and interest of any qualified education loan. The maximum exclusion is $5,250 and is indexed for inflation after 2026.

Section 529 plans. The law allows tax-exempt distributions for enrollment or attendance at elementary or secondary public, private or religious schools. It also provides for Qualified Postsecondary Credentialing Expenses. Payments for grades K-12 are now limited to $20,000 per year (up from $10,000).

Reinstatement of Partial Deduction for Charitable Contributions for Individuals that do not Itemize. Starting in the years after 2025, a deduction for charitable contributions is available to taxpayers who do not itemize their deductions. It is limited to $1,000 ($2,000 for a joint return). This law takes effect in the years after 2025.

0.5 Percent Floor on Deductions Made by Individuals. For individuals who do itemize, they are allowed a deduction for charitable contributions that exceed 0.5% of the contribution base. The contribution base is generally Adjusted Gross Income (AGI) computed without regard to any net operating loss carryback. This law takes effect in the years after 2025.

1 Percent Floor on Deduction of Charitable Contributions Made by Corporations. Corporations are allowed a charitable contribution for the amount that their contributions exceed 1% of the taxpayer’s taxable income for the year and cannot exceed 10% of the taxpayer’s taxable income for the year. This law takes effect in the years after 2025.

Expansion of Qualified Small Business Stock Gain Exclusion. The bill increases the Sec. 1202 exclusion for gain from qualified small business stock. For qualified small business stock acquired after the date of enactment of the bill and held for at least three years, the exclusion percentage is 50%. If it is held for four years, the percentage of gain excluded from gross income is 75%. If it is held for five years or more, the exclusion percentage increases to 100%.

Repeal of Revision to De Minimis Rules for Third-Party Network Transactions. The law reverts to the 1099-K reporting requirements prior to the changes made by the American Rescue Plan Act. The threshold for reporting is $20,000 or more in payments and 200 or more transactions.

Form 1099 Reporting. Under the previous law, 1099s were required when certain payments were made to individuals engaged in a trade or business that totaled $600 or more. The new law changes the threshold from $600 to $2,000.

The New Law Terminates Many Green New Deal Subsidies

- Section 25E: Previously owned Clean Vehicle Credit is terminated after September 30, 2025.

- Section 30D Clean Vehicle Credit is terminated after September 30, 2025.

- Section 45W Commercial Clean Vehicle Credit is terminated after September 30, 2025.

- Section 30C Alternative Fuel Refueling Property Credit is terminated after June 30, 2026.

- Section 25C Energy Efficient Home Improvement Credit is terminated after December 31, 2025.

- Section 25D Residential Clean Energy Credit is terminated after December 31, 2025.

- Section 179D Energy Efficient Commercial Buildings Deduction is terminated for property that begins construction after June 30, 2026.

- Section 45L New Energy Efficient Home Credit is terminated after June 30, 2026.

- Section 168€(3)(B)(vi) Cost Recovery for Energy Property is terminated after December 31, 2024.

Other credits have also been scheduled to terminate, but they are beyond the scope of this writing.

Excess business losses: The bill makes Section 461(l)(1) limitation on excess business losses of noncorporate taxpayers permanent. It was scheduled to expire after 2028.

- CONCLUSION

As I stated earlier, the new tax law spans nearly 1,000 pages; therefore, it is impossible to explain every aspect of the law in a concise e-book. I believe these are the provisions most pertinent to individuals, small businesses, and entrepreneurs. The law contains many other provisions pertaining to income, deductions, credits, and foreign taxes that are not addressed. The purpose of the ebook is to provide you with a certain level of knowledge, but this does not replace the expertise of a professional or further research if you are a professional.

<end>

Jeff Skolnick, CPA is is a regular guest contributor at One Click Advisor. He is a licensed CPA in the states of New York and New Jersey. For more of Jeff’s work, please visit Jeffrey Skolnick, CPA.